After much anticipation, the pilot program for the New York Secure Choice Savings Program is now in effect.

What does this mean for employers?

Employers in NYS that fall under a certain criteria and do not offer a retirement plan will be required to have an employer-sponsored plan implemented by January 2026.

Criteria:

- Employers with 10 or more employees (NYC is requiring employers with 5 or more employees).

- Have been in business for at least 2 years.

- Do not currently offer a qualified employer-sponsored retirement plan.

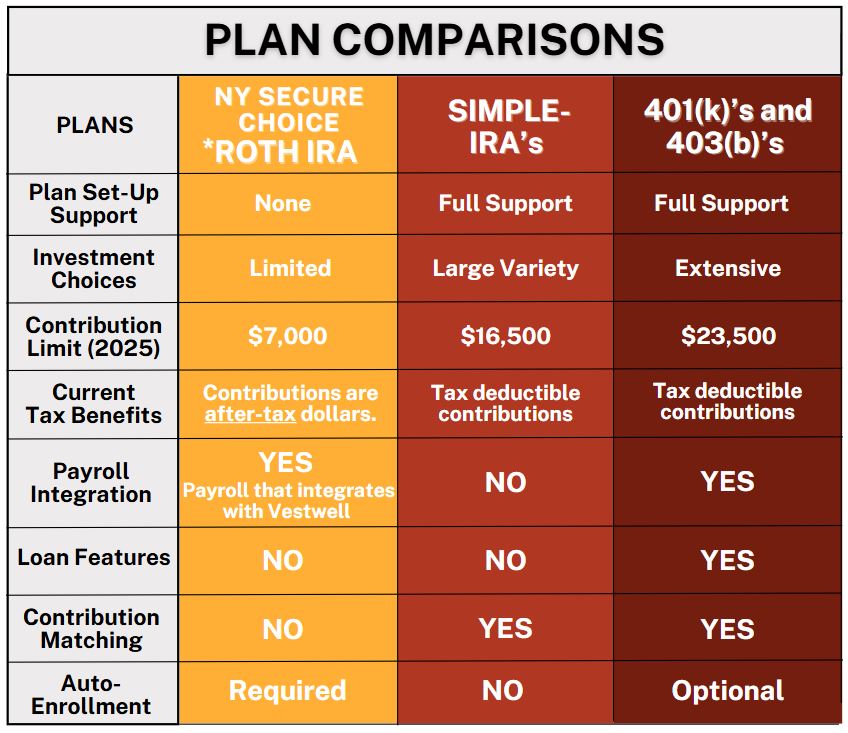

Consider Your Options

*A Roth IRA offers tax deferral on any earnings in the account. Qualified withdrawals of earnings from the account are tax-free. Withdrawals of earnings prior to age 59 ½ or prior to the account being opened for 5 years, whichever is later, may result in a 10% IRS penalty tax. Limitations and restrictions may apply.

401(k) Start-up Plan Tax Credits

Start-up plan tax credits are now offered that offset the majority of the Administrative Expense in the first few years of a new 401(k) or 403(b) plan making them very affordable for a business.

Payroll Integration

A key feature of employer-sponsored plan that significantly reduces the burden on employer’s is payroll integration. When information is updated in the payroll system it automatically feeds to the plan provider.

- Employers do not have to worry about tracking terminated and newly eligible employees.

- When employees change their contribution amount, employers do not have to manually update deductions in the payroll system.

To the consent that this material concerns tax matters, it is not intended or written to be used, and cannot be used or relied on by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Entities or persons distributing this information are no authorized to give tax or legal advice. Individuals are encourages to seek advice from their own tax or legal counsel.

The information contained is derived from sources believed to be accurate. However, we do not guarantee its accuracy. The information contained is for general use and it not intended to cover all aspects of a particular matter.