New York Secure Choice Savings Program

After much anticipation, the the New York Secure Choice Savings Program is now in effect. Employers in New York State that fall under a certain criteria and do not offer a retirement plan will be required to have an employer-sponsored plan implemented by the below deadlines based on company size:

DEADLINES:

| Business Size | Retirement Plan Deadline |

| 30+ employees | March 18, 2026 |

| 15–29 employees | May 15, 2026 |

| 10–14 employees | July 15, 2026 |

Criteria

- Employers with 10 or more employees.

- Have been in business for at least 2 years.

- Do not currently offer a qualified employer-sponsored retirement plan.

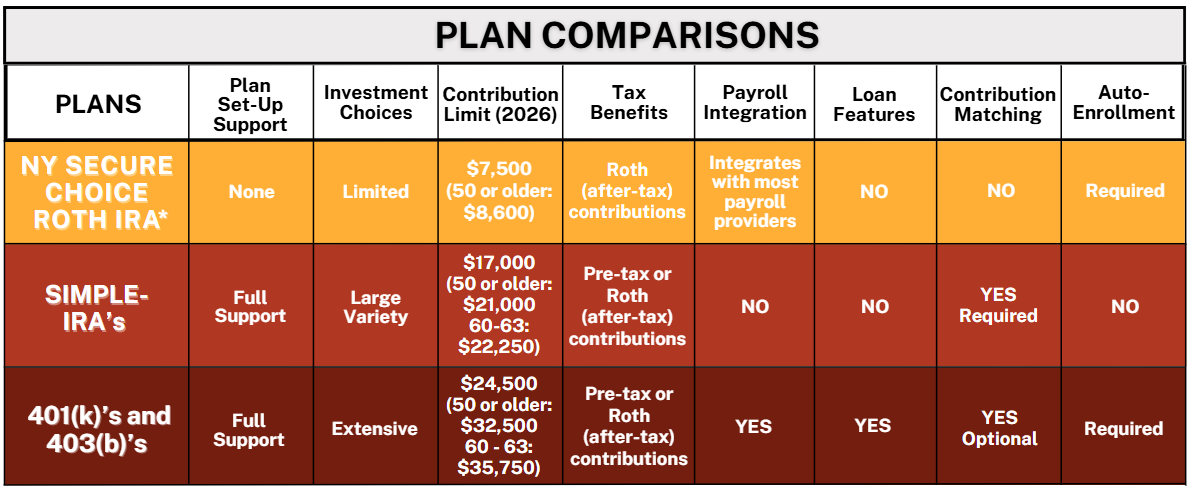

Is the State Plan Your Best Choice?

*A Roth IRA offers tax deferral on any earnings in the account. Qualified withdrawals of earnings from the account are tax-free. Withdrawals of earnings prior to age 59 ½ or prior to the account being opened for 5 years, whichever is later, may result in a 10% IRS penalty tax. Limitations and restrictions may apply.

*A Roth IRA offers tax deferral on any earnings in the account. Qualified withdrawals of earnings from the account are tax-free. Withdrawals of earnings prior to age 59 ½ or prior to the account being opened for 5 years, whichever is later, may result in a 10% IRS penalty tax. Limitations and restrictions may apply.

401(k) Startup Plan Tax Credits

Start-up plan tax credits are available that offset the majority of the Administrative Expense in the first few years of a new 401(k) or 403(b) plan making them very affordable for small businesses. There are 2 types of credits being offered:

- The SECURE ACT 2.0 created a new tax credit based on contributions the employer makes on behalf of participants.

- The SECURE ACT 2.0 expanded the existing tax credit on employer plan costs.

Requirements to Qualify:

- No more than 100 employees who received compensation of $5,000 or more in the preceding calendar year.

- The employer did not sponsor a retirement plan for a significant portion of the same employees in the prior three tax years.

1. The New Employer Contribution Tax Credit:

- Over the plan’s first five years, employers can receive a gradually decreasing tax credit of up to $1,000 per employee earning $100,000 or less annually, based on their contributions.

- The contribution tax credit is available for defined contribution plans like 401(k), SEP, and SIMPLE, as long as the employer has 100 or fewer employees.

- For businesses with 50 or fewer employees, the credit starts at a higher rate and gradually decreases over five years based on the schedule below.

- Larger plans with 51–100 employees follow the same phase-down schedule, but the credit is reduced by 2% for each employee beyond 50.

2. The Existing Plan Cost Tax Credit:

This credit covers a percentage of the employer’s cost to set up and administer the plan up to an annual limit.

- If 50 or fewer employees - Credit covers 100%

- If 51-100 employees - Credit covers 50%

The annual limit is $500 or, if greater, $250 multiplied by the number of plan-eligible non-highly compensated employees (NHCEs), up to $5,000.

Employer Contributions

Employer contributions are a huge benefit not just to employees, but employers as well.

Helps with Employee Recruitment & Retention:

- Offering employer contributions makes a company more competitive and appealing to top talent.

Boosts Employee Morale:

- A solid benefits package, including a strong retirement plan improves overall employee satisfaction and loyalty.

Tax Advantages:

- Employer contributions are typically tax-deductible as a business expense, reducing overall taxable income.

- For small businesses, the SECURE ACT 2.0 offers valuable tax credits on employer contributions.

Payroll Integration

A key feature of employer-sponsored plan that significantly reduces the burden on employer's is payroll integration. When information is updated in the payroll system it automatically feeds to the plan provider.

- Employers do not have to worry about tracking terminated and newly eligible employees.

- When employees change their contribution amount, employers do not have to manually update deductions in the payroll system.