New York Secure Choice Savings Program

After much anticipation, the pilot program for the New York Secure Choice Savings Program is now in effect. Employers in New York State that fall under a certain criteria and do not offer a retirement plan will be required to have an employer-sponsored plan implemented by January 2026.

Criteria

- Employers with 10 or more employees (NYC is requiring employers with 5 or more employees).

- Have been in business for at least 2 years.

- Do not currently offer a qualified employer-sponsored retirement plan.

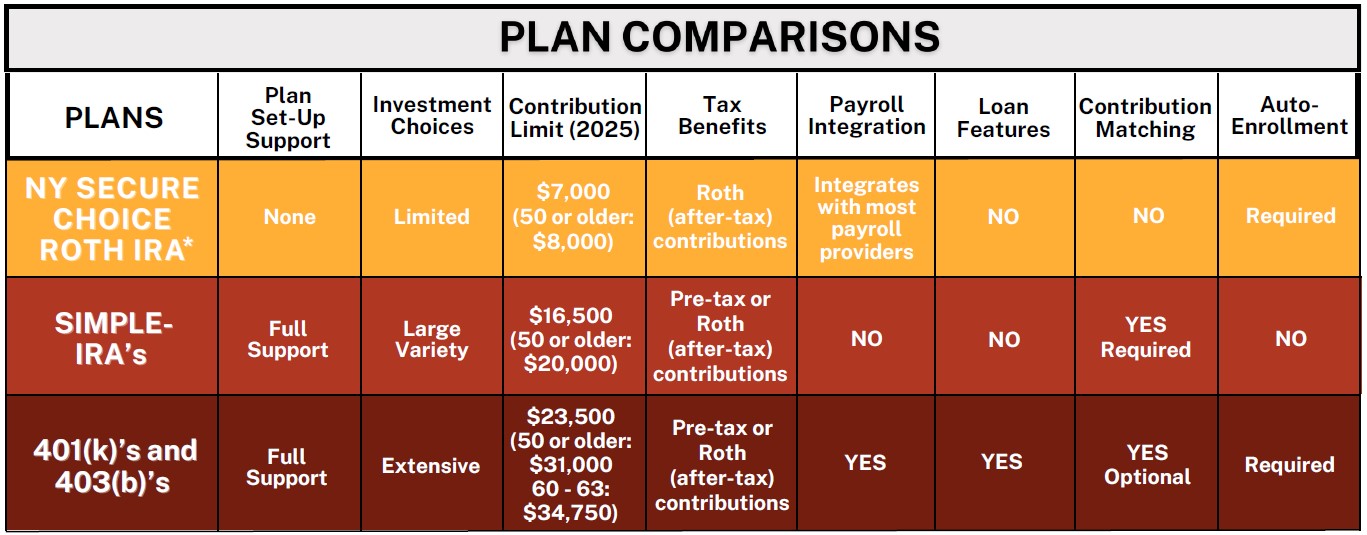

Is the State Plan Your Best Choice?

*A Roth IRA offers tax deferral on any earnings in the account. Qualified withdrawals of earnings from the account are tax-free. Withdrawals of earnings prior to age 59 ½ or prior to the account being opened for 5 years, whichever is later, may result in a 10% IRS penalty tax. Limitations and restrictions may apply.

401(k) Startup Plan Tax Credits

Start-up plan tax credits are available that offset the majority of the Administrative Expense in the first few years of a new 401(k) or 403(b) plan making them very affordable for small businesses. There are 2 types of credits being offered:

- The SECURE ACT 2.0 created a new tax credit based on contributions the employer makes on behalf of participants.

- The SECURE ACT 2.0 expanded the existing tax credit on employer plan costs.

Requirements to Qualify:

- No more than 100 employees who received compensation of $5,000 or more in the preceding calendar year.

- The employer did not sponsor a retirement plan for a significant portion of the same employees in the prior three tax years.

1. The New Employer Contribution Tax Credit:

- Over the plan’s first five years, employers can receive a gradually decreasing tax credit of up to $1,000 per employee earning $100,000 or less annually, based on their contributions.

- The contribution tax credit is available for defined contribution plans like 401(k), SEP, and SIMPLE, as long as the employer has 100 or fewer employees.

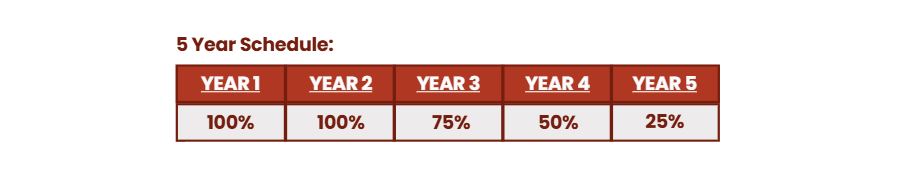

- For businesses with 50 or fewer employees, the credit starts at a higher rate and gradually decreases over five years based on the schedule below.

- Larger plans with 51–100 employees follow the same phase-down schedule, but the credit is reduced by 2% for each employee beyond 50.

2. The Existing Plan Cost Tax Credit:

This credit covers a percentage of the employer’s cost to set up and administer the plan up to an annual limit.

- If 50 or fewer employees - Credit covers 100%

- If 51-100 employees - Credit covers 50%

The annual limit is $500 or, if greater, $250 multiplied by the number of plan-eligible non-highly compensated employees (NHCEs), up to $5,000.

Employer Contributions

Employer contributions are a huge benefit not just to employees, but employers as well.

Helps with Employee Recruitment & Retention:

- Offering employer contributions makes a company more competitive and appealing to top talent.

Boosts Employee Morale:

- A solid benefits package, including a strong retirement plan improves overall employee satisfaction and loyalty.

Tax Advantages:

- Employer contributions are typically tax-deductible as a business expense, reducing overall taxable income.

- For small businesses, the SECURE ACT 2.0 offers valuable tax credits on employer contributions.

Payroll Integration

A key feature of employer-sponsored plan that significantly reduces the burden on employer's is payroll integration. When information is updated in the payroll system it automatically feeds to the plan provider.

- Employers do not have to worry about tracking terminated and newly eligible employees.

- When employees change their contribution amount, employers do not have to manually update deductions in the payroll system.